Real Wages: What are they?

One of the biggest economic concerns in recent years has been the stagnation of wages, but many times, simply looking at those numbers on a paycheck—the nominal wage—is not enough to tell if wages have really gone up or down. Sometimes, it is necessary to look at real wages.

Real wages measure your purchasing power—how effective the money you make is, rather than simply the nominal (or dollar) amount. It does this by subtracting inflation from nominal wage. For instance, if you are receiving the same amount of money, but everything costs more, then your real wages have actually gone down. Investopedia gives an example of real rages (or real income) thus: “if you received a 2% salary rise over the previous year and inflation for the year was 1%, then your real income only rose 1%. Conversely, if you received a 2% raise in salary and inflation stood at 3%, then your real income would have shrunk 1%.”

So then, what’s the deal with real wages in the US?

Well, Business Insider has an article arguing that, despite not having been paid more, you are being paid more.

The above chart shows that, while nominal wages have not increased in the past year, real wages (nominal minus inflation) have. That is because inflation has been decreasing.

The Liquid Gold Factor

One major factor that may be influencing this type of real wage growth is the price of oil, which plummeted recently and has stayed low for quite a while. Here are the August Consumer Price Index (CPI) numbers from the Bureau of Labor and Statistics (BLS):

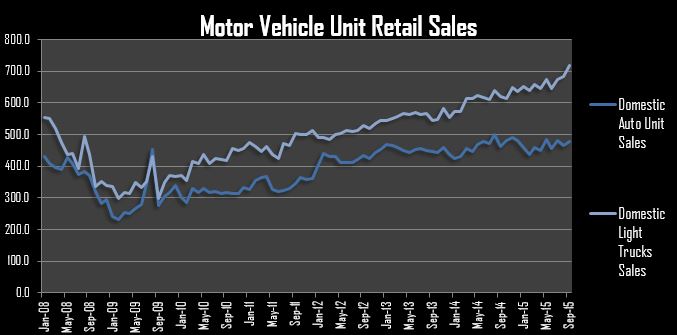

The CPI is a measure of inflation. Notice that, if you take out food and energy, food and energy, inflation has stayed relatively level. Adding in fuel oil, however, brings down the CPI. Fuel oil dropped 8.1% in August of 2015. That may have had some impact in the decision making of consumers, who have lately been spending on big-ticket items such as cars, which are necessary to go to work. Notice the motor sales of the country (data from the Bureau of Economic Analysis):

Note especially the domestic light truck sales! Domestic light truck sales have skyrocketed. Anyone who watches NFL football come Sunday, Monday, and Thursday knows that the only commercials you cannot avoid seeing are those for beer, fantasy football, and trucks. Think about all those Chevy and Ford commercials. Been a ton of them lately, right? This chart should provide some answer to the question why.

Summing it Up

While nothing, including the CPI or real wage numbers, is perfect, some indicators can help us better understand what is driving motors sales or how effective the money we make on a weekly, monthly, or yearly basis is. The BLS reports that:

“Real average hourly earnings increased 2.0 percent seasonally adjusted, from August 2014 to August 2015. This increase in real average hourly earnings combined with a 0.3-percent increase in the average workweek resulted in a 2.3-percent increase in real average weekly earnings over this period.”

In short, inflation—the change in prices—is actually pretty powerful. It can essentially make your wages go up or down… even if the number on the paycheck looks unchanged.