The News can Hurt Sometimes

Biotechnology firms have been suffering recently due to a barrage of negative news. Martin Shkreli, former hedge-fund manager, now CEO of Turing Pharmaceuticals AG, attempted to spike the price of the drug Daraprim to $750 per pill. Some claim that this is not unusual for pharmaceutical companies producing rarely-used drugs, and that Shkreli was simply to brazen about the news. Regardless, the news of the price hike attracted the attention of presidential candidate Hilary Clinton, who called the price hike “outrageous” and decided to announce that if elected, she would propose government intervention in the price of pharmaceutical drugs. That’s when it hit. Biotech stocks have dropped, and are still dropping, as a result of Clinton’s comments and the public backlash, but all is not lost!

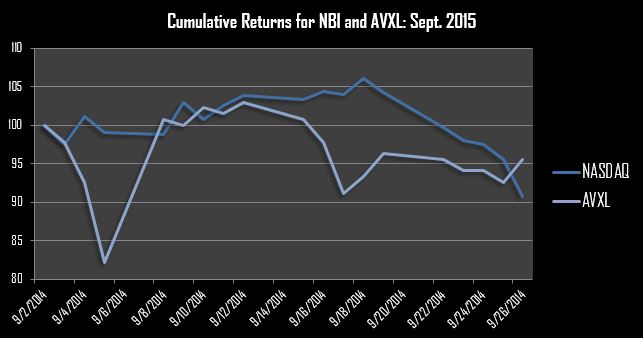

Remember, research is our best friend and it is good to remind ourselves to keep it in mind! For instance, Bell Tower Associates’ Correlation Study showed how individual biotech stocks are not correlated to the NASDAQ Biotechnology Index. What does that mean exactly? It means that not all biotech stocks are going to plummet simply because the NASDAQ is going down. For example, let’s look at Anavex Life Sciences (AVXL) again:

If you notice, Anavex has not even been hit by the recent turn of events. It has stayed calm and collected; trading around the same 1.3 it has been for about a month. The NASDAQ, on the other hand, has fallen precipitously. It does not take a portfolio analyst to realize that these two are hardly correlated at all!

This is just a reminder that, as stated in our last post, it is more important to look at these biotech stocks on the basis of their value rather than on their relation to the index. Just take a look at this next chart:

Yet another reminder of how uncorrelated the biotech industry is. Remember, what matters is the biotech company itself. In the end, a biotech firm with a good product that can survive testing and competent, market-savvy management will have the greatest value in the long run. And, for better or worse, there’s no way to index scientific testing!

Data from Yahoo! Finance